Trump’s trade war has disrupted global markets, including Bitcoin. In this article, we explore how Trump’s tariffs influence Bitcoin’s price and whether it can serve as a safe investment in times of economic uncertainty.

What Is Trump’s Trade War?

Trump’s trade war began in 2018, with the U.S. imposing tariffs on goods from China and other countries. The goal was to reduce the trade deficit and protect U.S. industries. However, tariffs led to higher costs for consumers and businesses. The trade war also increased tensions in international markets, causing significant disruptions.

The effects of the trade war reached beyond traditional financial markets. Trump’s tariffs impacted the value of the U.S. dollar and made many investors consider alternatives like Bitcoin.

How Trump’s Trade War Affects the U.S. Dollar

Trump’s trade war has weakened the U.S. dollar. By imposing tariffs on imports, the price of goods has risen. This inflation reduces consumer purchasing power, and the U.S. dollar loses strength.

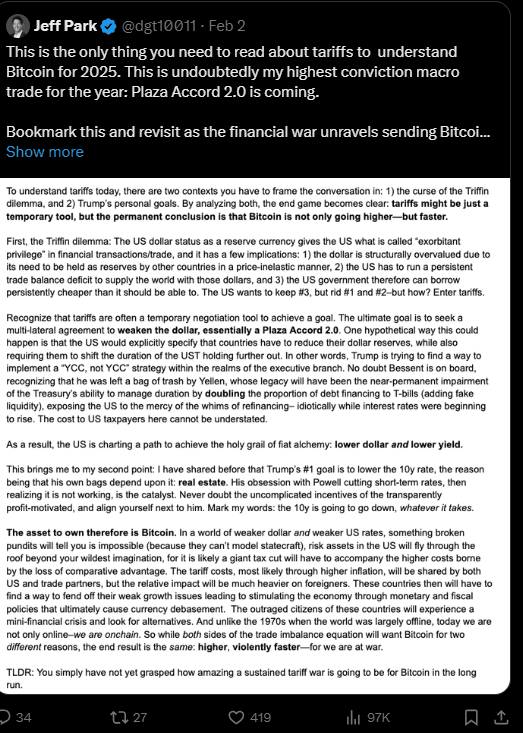

According to financial expert Jeff Park, this decrease in the dollar’s value causes investors to seek assets that are more stable. Bitcoin, which is independent of government control, becomes an attractive alternative. As the U.S. dollar weakens, Bitcoin often becomes more appealing as a safe asset for those worried about inflation and the trade war’s effects.

Can Bitcoin Protect Against Inflation?

Bitcoin has increasingly been seen as a hedge against inflation. Unlike the U.S. dollar, which can be printed in large amounts, Bitcoin has a limited supply of 21 million coins. This fixed supply helps it retain value during inflationary times.

Jeff Park highlights that Bitcoin can preserve wealth better than traditional currencies when inflation is high. In countries like Venezuela, where inflation is extreme, people have turned to Bitcoin to avoid losing their savings. Bitcoin’s fixed supply makes it a stronger store of value, especially as the U.S. dollar weakens amid Trump’s trade war.

However, Bitcoin still has its volatility. While it can protect against long-term inflation, its price can fluctuate in the short term due to market uncertainty, such as that caused by the trade war.

Short-Term Volatility in Bitcoin’s Price

Despite its long-term potential, Bitcoin’s short-term price volatility remains a key challenge. The uncertainty created by Trump’s trade war has triggered price swings in Bitcoin. When tariffs are announced, Bitcoin’s value can rise as investors move away from traditional assets. But when trade talks show signs of improvement, Bitcoin’s price can fall just as quickly.

Jeff Park explains that Bitcoin’s volatility offers both opportunities and risks. While it can surge during times of uncertainty, it can also experience sharp drops. Investors should keep this in mind when considering Bitcoin as an investment during Trump’s trade war.

Bitcoin as a Global Asset During Trade Wars

One of Bitcoin’s unique features is its ability to function globally, without being tied to any single government or currency. This makes Bitcoin an appealing asset when global trade is in turmoil. Trump’s trade war has disrupted supply chains and hurt traditional financial markets, but Bitcoin remains a decentralized asset.

Jeff Park believes that Bitcoin’s decentralized nature makes it an attractive option for investors looking to safeguard their wealth. With Bitcoin, investors aren’t dependent on the economic policies of any one nation, making it a more stable option during times of global economic uncertainty.

Furthermore, Bitcoin’s borderless nature makes it easy to move across countries without restrictions, unlike traditional currencies that are subject to devaluation and capital controls.

Institutional Interest in Bitcoin

Bitcoin’s growing appeal among institutional investors is also worth noting. More hedge funds, financial firms, and publicly traded companies are now investing in Bitcoin. This shift signals that Bitcoin is becoming a more established asset.

Jeff Park points out that institutional investment is helping to reduce Bitcoin’s volatility. Large investors have a long-term outlook and tend to be less affected by short-term market shifts. This growing interest could lead to more price stability for Bitcoin, making it an even more attractive investment during economic uncertainty caused by Trump’s trade war.

Is Bitcoin a Safe Investment Amid Trump’s Trade War?

Trump’s trade war has shaken global markets and weakened the U.S. dollar. During these turbulent times, many investors have looked to Bitcoin as a potential hedge against inflation. Bitcoin’s limited supply and decentralized nature make it an appealing alternative to traditional currencies.

While Bitcoin may offer long-term protection against inflation, its short-term price swings remain a challenge. Market uncertainty, particularly related to Trump’s trade war, can lead to sharp fluctuations in Bitcoin’s price. Investors must carefully weigh the risks and rewards before committing to Bitcoin as a hedge.

Jeff Park emphasizes that Bitcoin’s long-term potential remains strong, but investors should be prepared for its volatility. Bitcoin’s role in the global economy is growing, and its increasing adoption by institutional investors could bring more stability. However, for now, Bitcoin’s price will continue to reflect global events, including the ongoing impact of Trump’s trade war.

Conclusion

Trump’s trade war has created significant economic uncertainty, weakening the U.S. dollar and increasing inflation. As a result, many investors have turned to Bitcoin as a hedge against these risks. While Bitcoin can offer long-term protection against inflation, its price volatility remains a concern, especially in response to the ongoing trade war.

Investors should consider both the potential rewards and the risks of Bitcoin before deciding to invest. With increasing institutional interest and a growing role in the global economy, Bitcoin could become a more stable asset over time. However, for those looking to protect their wealth in the short term, Bitcoin’s volatility should not be underestimated.